The mining and metals industry is recovering from one of its most difficult periods in decades. Market volatility and a downturn in commodity prices have created a new normal where cost cuts, automation and operational efficiency are vitally important.

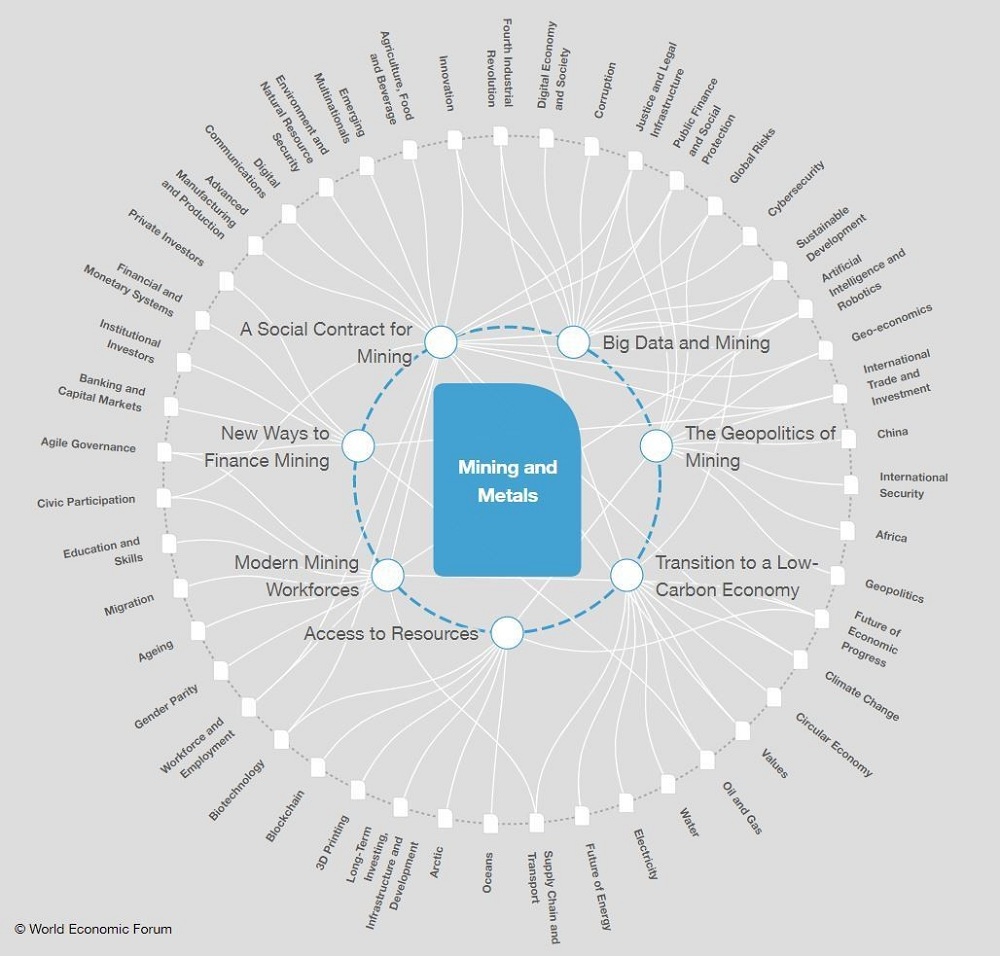

Meanwhile, industry-specific issues related to regulation, geopolitical risk, legal limits on natural resource use, shareholder activism and public scrutiny have created additional challenges. While we believe that demand for minerals will grow in the coming years, there are several trends that will determine which types of mining companies will prevail in the future. We have identified the following seven drivers that we believe will shape the mining and metals sector.

1. Transition to a low-carbon economy

Demand for most minerals is projected to be high in order to achieve the energy transition. While fossil fuels have helped to improve living standards around the world since the 18th century, their associated greenhouse gas emissions have led to global warming. In order to avoid reaching temperatures that will have catastrophic consequences for the planet, countries must decarbonize their energy systems by the middle of this century. Given that low-emission energy and transportation systems are more mineral-intensive than their fossil fuel-based counterparts, the transition provides a great opportunity for the mining sector. At the same time, the mining sector will have to reduce its own emissions. Mining companies that power their operations with renewable energy, operate electric or hydrogen-powered truck fleets and integrate recycling in their value chains will be best placed to sell low-carbon premium minerals.

2. Access to resources

Companies will need to venture into frontier mining areas. As world-class mineral resources in low-risk areas become exhausted, mining companies must either master new technologies for extraction and processing, or venture into frontier areas where extraction has not previously been economically viable. Automation and digitalization will result in more targeted and efficient mining, which could further be enhanced through technological breakthroughs in areas such as in-situ leaching (a mining process used to recover minerals such as copper and uranium through boreholes drilled into a deposit), block caving (an underground mining method that uses gravity to exploit ore bodies located at depth) or bio mining (a technique for extracting metals from ores and other solid materials typically using prokaryotes or fungi).

Mining jurisdictions with higher perceived risks may see increasing levels of interest from investors. In the search for high-grade ore deposits, deep sea and asteroid mining will be increasingly explored by governments and companies. While these technologies will open up new ways for mining companies to optimize the valorization of existing resources or allow access to new ones, they are unchartered territory in terms of business models, processes, and potential social and environmental externalities.

3. New ways to finance mining

As mining companies try to limit risk, novel financing and production models will become more common. After demand from China triggered a commodity boom in the first decade of the 21st century, prices collapsed and mining companies were forced to focus on reducing debt ratios and improving their balance sheets. Alternative financing solutions were developed such as royalty and metal stream agreements that reduce the burden on mining companies’ balance sheets. To spread the risk of new capital-intensive projects, these financing solutions are likely to continue to grow. Companies may also seek to develop joint ventures similar to those observed in the oil and gas sector in order to reduce their exposure to a particular project or jurisdiction and may also consider service agreements.

4. A social contract for mining

Creating real benefits for communities near mine sites will be key for successful new projects. Obtaining the ‘license to operate’ from local communities has been a challenge for the mining industry in recent years. Many proposed projects have been rejected, and operations have been disrupted by protests. With a record number of mines nearing the end of their life and insufficient money being set aside for remediation; with new mining projects increasing the sector’s footprint without necessarily providing additional employment opportunities at the local level due to automation; and with increased water stress and extreme weather events due to global warming: local opposition to mining is likely to increase if no new business models are developed that benefit the affected communities.

5. Big data and mining

Data transparency to aid the mining industry’s relations with stakeholders. Collecting and processing massive amounts of data will be essential for mining companies as they digitalize and automate their operations. What data should be shared and made transparent will continue to be a major area of debate. Governments will seek to further push for disclosure of subsidiary structures to address tax base erosion; consumers will seek to increase value chain transparency; investors will use the proliferation of non-financial data to better assess the risks of their mining portfolios; civil society will continue to push for companies to go beyond the mandatory EITI Standard; and impacted communities are particularly interested in accessing data that capture the externalities that affect them. It will be key for companies to work together with other stakeholders in order to understand the types of data that should be made available and the appropriate format that data disclosure should take, in order to ensure standardization, usefulness and impact.

6. The geopolitics of mining

Mining companies must navigate rising geopolitical risk and economic protectionism. A growing popular resistance to globalization and free trade is altering politics, and directly affecting the mining and metals sector. Policymakers in mining jurisdictions are increasingly trying to enact local content laws and regulations which require minerals to be processed before they are exported. At the same time, import restrictions on semi-finished products such as steel and aluminum are at the center of recent trade disputes. Trade wars and increasing protectionism are likely to dampen global commodity demand and disrupt the value chain of mining and metals companies. In the ‘critical minerals’ sector, which is central to high-tech and future-oriented industries, this trend is further complicated by market consolidation in the hands of a few players. Further consolidation, geopolitical manoeuvring and muscle-flexing could create challenges for companies that have so far prospered under a system of relatively free trade – while creating opportunities for domestic projects that might not be economically viable without government intervention.

7. Modern mining workforces

Maintaining an open dialogue will be key as mining companies try to revamp their employee base. Constantly evolving technologies and business models will require mining company employees to develop new skills. The sector will have to increasingly compete with the IT sector to attract top talent from universities in order to drive its digitalization and automation processes. Governments and companies will have to work together to help transition workers that cannot be absorbed by an automated mining sector to new activities through retraining and transitioning programs. The speed at which mining companies will be able to rollout new technologies at their mine sites will be closely linked to the host government’s and labour unions’ acceptance of reduced employment and procurement opportunities. As such, these actors need to be involved in the decision-making around the transition and in strategizing policies to support those who will be negatively affected.

Nicolas Maennling and Perrine Toledano are co-curators of the World Economic Forum’s Transformation Map on Mining and Metals.

Source: World Economic Forum