Resilient GDP growth and falling inflation are spurring a brighter outlook for 2024, although cautions remain across global economies.

While investors are hopeful that U.S. rate cuts could happen as early as May, the Fed has signaled that it won’t “declare victory” too soon. As countries around the world maneuver a complex landscape, they are faced with a scope of risks that include inflationary spikes, rising debt loads, and dwindling consumer savings.

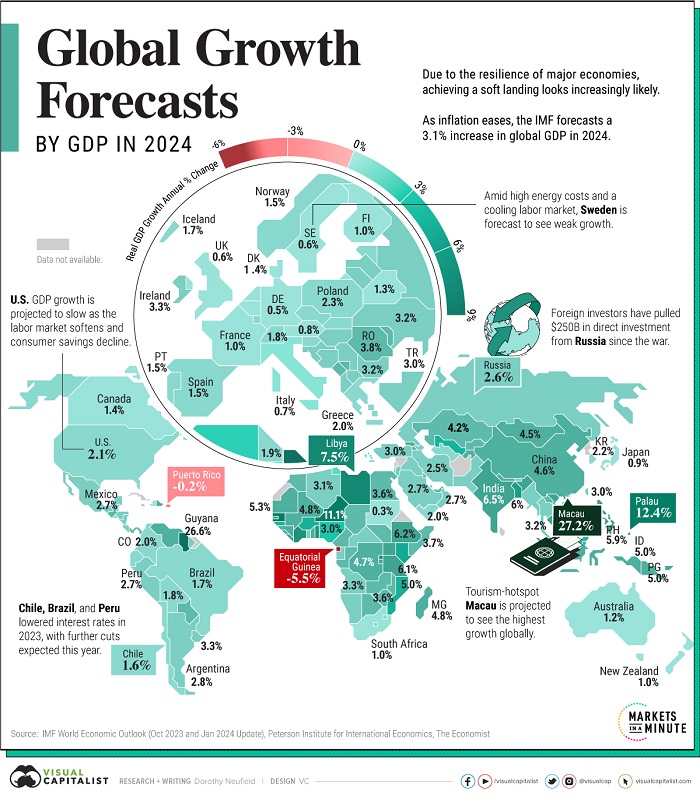

This graphic shows global GDP growth projections in 2024, based on the International Monetary Fund (IMF).

Global GDP Growth Outlook 2024

Global GDP Growth Outlook 2024

In 2024, real GDP growth is forecast to increase 3.1%, a slight rise from October’s outlook.

In China, property market woes are dragging on economic growth. Declining real estate values have impacted incomes, assets, and the public mood. Due to these headwinds, consumption growth is forecast to drop over the year.

Over in Latin America, Chile and Brazil were among the first emerging countries to hike interest rates in 2021—and they were some of the first to cut them last year. Thanks to improving domestic demand amid dissipating price spikes, the IMF upgraded the outlooks for Brazil and Mexico in 2024.

The lowest growth across all regions is forecast to be seen in Europe, at 0.9%. In late 2023, Signa, a multi-billion European property firm collapsed following the sharpest rise in interest rates in the European Union’s 25-year history. Also dimming the outlook is low consumer sentiment and the impact of high energy prices.

What are the Key Risks?

While no one holds a crystal ball, there are certain risks outlined by the IMF that could negatively impact global GDP growth:

- Sharply Rising Commodity Prices

- Stubborn Inflation

- China’s Economy Slows

While these risks remain present, the economy could witness positive surprises as well. Should inflation fall faster than expected, it would likely lead to monetary easing and a boost to global economic growth. Overall, the global economy defied expectations in 2023, and it may do the same in 2024.

Source: www.visualcapitalist.com