Following the recent announcement by U.S. President Donald Trump to temporarily suspend additional tariffs on marble imports from most countries for a 90-day period, attention has once again shifted to the geoeconomic dynamics of the global natural stone industry.

The decision brings short-term relief to key exporters such as Italy, Turkey, and India—countries with significant export dependency on the U.S. market. However, China is explicitly excluded from this preferential treatment: tariffs on Chinese marble remain in place and have been raised to 145%, escalating existing trade tensions and highlighting the targeted nature of U.S. trade policy toward Chinese stone.

Who is most exposed to the U.S. market?

The United States continues to be one of the world’s largest marble importers, both in terms of volume and value. For many producing countries, the U.S. is a strategic trade partner, and any shift in Washington’s trade policy directly impacts export performance.

To assess the level of exposure to U.S. tariffs, available data on each country’s marble export share to the U.S.—in both value and volume—has been analyzed.

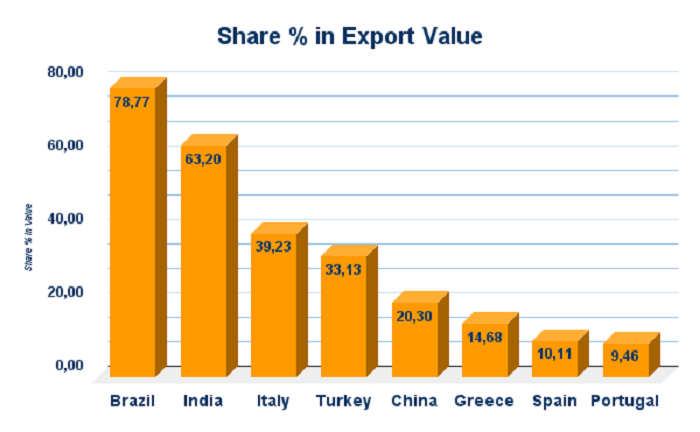

Export Dependence by Value:

-

Brazil: The most exposed country, with 78.77% of its marble export value directed to the U.S. This high dependency makes Brazilian producers highly vulnerable to any tariff changes.

-

India: With 63.20% of its marble exports heading to the U.S., India operates in a transitional phase between volume-driven exports and a focus on added value.

-

Italy: A significant share at 39.23%, mainly in the form of high-end, processed marble products, which can offer some degree of resilience against tariff fluctuations.

-

Turkey: With 33.13% of its marble export value relying on the U.S., Turkey’s shipments often consist of raw or semi-finished products, traded at competitive prices.

-

China: Although the dependency rate is lower at 20.30%, the political targeting of Chinese exports means that the impact of U.S. tariffs is disproportionately severe.

-

Greece, Spain, Portugal: These Southern European countries show lower levels of dependency (between 9% and 15%), which may allow them to adapt more flexibly to trade disruptions.

Export Dependence by Volume:

Export Dependence by Volume:

Volume data confirms similar patterns:

-

Brazil: Also ranks first by volume, with 79.26% of its marble exports going to the U.S.

-

India: Follows with 61.66%, reflecting a high-output model still heavily tied to American demand.

-

Turkey: Surpasses Italy in volume terms, indicating a lower average processing level of its exports.

-

China: Despite only 12.97% of its marble export volume being shipped to the U.S., political restrictions amplify the trade burden.

Diversification and Resilience Strategies

Diversification and Resilience Strategies

Export dependency cannot be measured in numbers alone. Geographical diversification plays a key role in a country’s resilience:

-

Countries like Brazil and India, with a high concentration of exports to the U.S., face significant systemic risk.

-

In contrast, countries with a more balanced global presence—such as Portugal, Spain, and Greece—have greater adaptability and may even gain market share if demand shifts due to tariff changes.

Strategic Takeaways for the Industry

The temporary suspension of tariffs should be viewed as a reprieve, not a resolution. The global trade environment remains volatile, and countries with high U.S. dependency must:

-

Develop strategies to diversify their export destinations

-

Increase competitiveness through quality and product refinement

-

Invest in trade relationships beyond the U.S. market

China’s case serves as a reminder that political risk can outweigh even modest trade exposure. In this shifting landscape, geoeconomic strategy is more crucial than ever for players in the natural stone sector.