Global mining deal value, suffering from an unanticipated shock from the COVID-19 pandemic, fell by over US$18bn when compared to the first half of 2019 to US$46.6bn in the first half of 2020. An expected slump in the global economy, steered by a series of challenges, has kept investors away from long-term financial instruments, resulting in a 12.7% y-o-y fall in the capital raised by mining companies, according to GlobalData, a leading data and analytics company.

Mining mergers and acquisitions (M&As), despite a decent first quarter owing to deals involving gold, fell by 51.6% during the first half of 2020. Overall, the majority of the impact was evident on the completion rate, as there was a 41.7% y-o-y fall in the completed deal value.

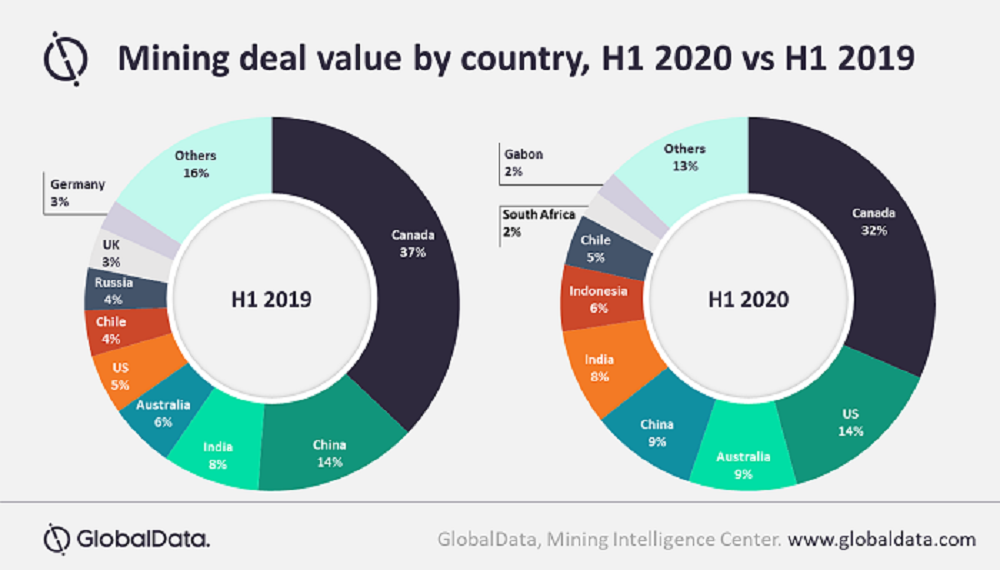

Vinneth Bajaj, Senior Mining Analyst at GlobalData, comments: “The total volume of deals increased from 1,811 in H1 2019 to 2,271 in H1 2020 owing to a 79.7% increase in the total number of announced capital raising deals in that period. This was accompanied by a 28.4% increase in the volume of completed M&A deals. Canada, US, Australia, China and India accounted for nearly 87% of the total deal volume and over 72% of the total deal value.”

Source: www.globaldata.com