The year ahead looks better than initially feared for the global economy, but remains fraught with risks, including the potential escalation of the war in Ukraine and the emergence of a transatlantic trade war, the final panel at the World Economic Forum’s Annual Meeting in Davos concluded.

International Monetary Fund (IMF) Managing Director Kristalina Georgieva told Davos that what had improved was the potential for China to boost growth, but she warned: “We have to be cautious”. Global growth is still expected to slow to one of its lowest rates in recent decades, senior UN economists say. They expect growth to drop to 1.9% this year from 3% in 2022 because of intersecting crises such the Ukraine war, surging inflation, debt tightening and the climate emergency. The World Bank sees growth sliding to 1.7%.

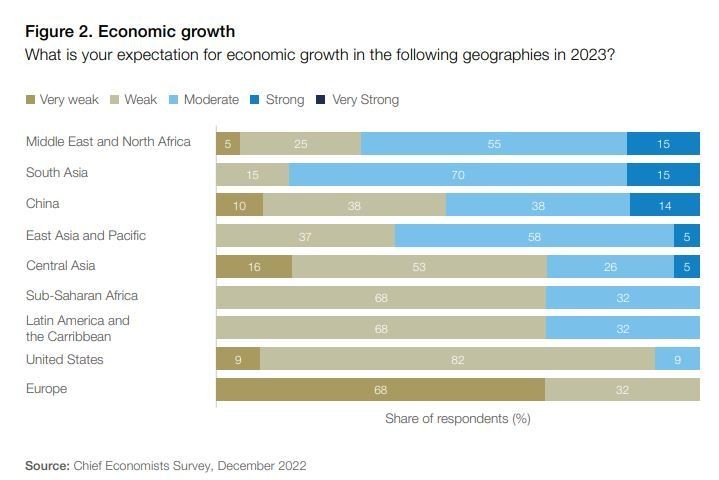

A global recession is seen as likely by two-thirds of respondents to the World Economic Forum’s Chief Economists Outlook: January 2023, of which 18% consider it extremely likely – more than twice as many as in the previous survey in September 2022. However, the report also points to tentative grounds for optimism, including a possible easing of the cost-of-living and energy crises.

Concerns about trade and the fracturing of globalization were a key theme at Davos. Several speakers said that multilateralism and cooperation remain effective tools for prosperity, and that economic fragmentation and trends such as “friendshoring” – relocating supply chains within a group of countries with shared values – will be expensive because they will lead to inefficiencies and duplication, and therefore to inflation.

Another risk facing the world economy is trade wars over clean energy subsidies. The EU is reviewing its state aid rules to support the green energy industry, in response to the subsidies and tax breaks contained in the US Inflation Reduction Act.

Slowing exports from key Asian economies are also stoking fears of a further slowdown in the global economy. Japan’s export growth slowed sharply in December as China-bound shipments fell for the first time in seven months, with a slump in sales of cars, car parts and chip-making machinery. And South Korea’s economy contracted for the first time in 2.5 years in the fourth quarter of 2022 – its exports of high-tech products have been falling because of the weaker global economy and China’s recent slowdown.

Source: www.weforum.org