The pandemic, supply chain problems and inflation have negatively affected the import volume of raw marble and granite in the first quarter of 2022.

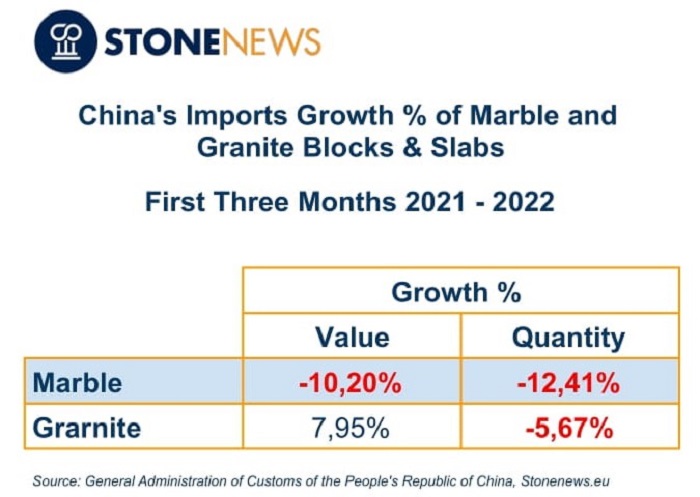

In terms of import values of the two materials, marble declined compared to Q1 2021, while granite showed an increase. The table below shows the changes in import values and quantities between the first quarter of 2021 and the first quarter of 2022:

The quantity of imports in Q1 2022 is the lowest in the last five years, while, in contrast, the average price per tonne is the highest. The value of imports has remained at 2019 levels.

The quantity of imports in Q1 2022 is the lowest in the last five years, while, in contrast, the average price per tonne is the highest. The value of imports has remained at 2019 levels.

In raw granite imports, the average price per tonne in the first quarter of 2022 is the highest in five years the value remained high thanks to the increase, while, on the contrary, the quantity showed a decrease and fell to a low level.

The pandemic, supply chain problems and inflation have negatively affected the import volume of raw marble and granite in the first quarter of 2022.

Imports of marble blocks and slabs from Turkey, China’s primary supplier, Greece and Egypt fell. In contrast, imports from Iran and Italy recorded an increase.

Imports of raw granite from India between the first quarter of 2021 and the first quarter of 2022 saw an increase in value and a decrease in quantity. In contrast, imports from Brazil saw an increase in both value and quantity.

*The statistics are derived from the analysis of the Tariff Class Codes – Harmonized System (HS) Codes:

25151100: Marble & travertine, crude or roughly trimmed.

25151200: Marble & travertine, merely cut into a square / rectangular blocks / slabs.

25181000: Dolomite, not calcined / sintered.

25161100: Granite, crude or roughly trimmed.

25161200: Granite, merely cut into a square / rectangular blocks / slabs.

*Due to consistent data flow, statistics may alter during the year

For more statistics contact [email protected]