What will be the impact of COVID-19 on the marble exports of the world’s largest suppliers in the first half of 2020?

Suppliers of raw and finished marble are faced with an unprecedented situation. After the strong side effects in the international market from the trade war between USA. and China came the Covid-19 crisis which indiscriminately affects all markets.

Specifically, the largest suppliers of raw and finished marble in the world *, such as Turkey, China, Italy, Greece, Spain, Portugal, recorded a large decline in the volume of exports between the first half of 2019 – 2020 ranging from 10% to 40%.

In Table 1 below we see the changes by country in the total marble exports between the first half of 2019 – 2020.

Between the first half of 2019 – 2020 we clearly see the size of the fall. China, with exports of almost exclusively finished marble, 99% of the total, recorded the smallest decline in value and quantity.

Between the first half of 2019 – 2020 we clearly see the size of the fall. China, with exports of almost exclusively finished marble, 99% of the total, recorded the smallest decline in value and quantity.

China is the world’s largest importer of raw marble, so the impact of the pandemic and lockdown since late January has been felt rapidly in other countries, which have seen crude marble exports fall sharply. According to Chinese statistics, between the first half of 2019 – 2020, there is a decrease in imports of raw marble of 30.01% in quantity and 15.74% in value.

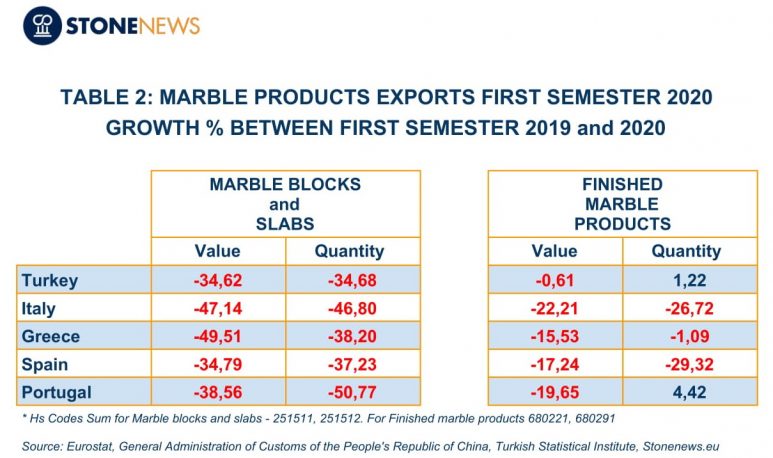

The impact is shown in Table 2 that follows where we see comparatively the changes per country in the exports of raw – finished marble between the first half of 2019 – 2020.

In Table 2 we observe the large decrease in exports of raw marble compared to the significantly smaller of finished marble which also affected their structure. In Table 3 below we see the% shares between raw and processed marble on total exports of marble products.

In Table 2 we observe the large decrease in exports of raw marble compared to the significantly smaller of finished marble which also affected their structure. In Table 3 below we see the% shares between raw and processed marble on total exports of marble products.

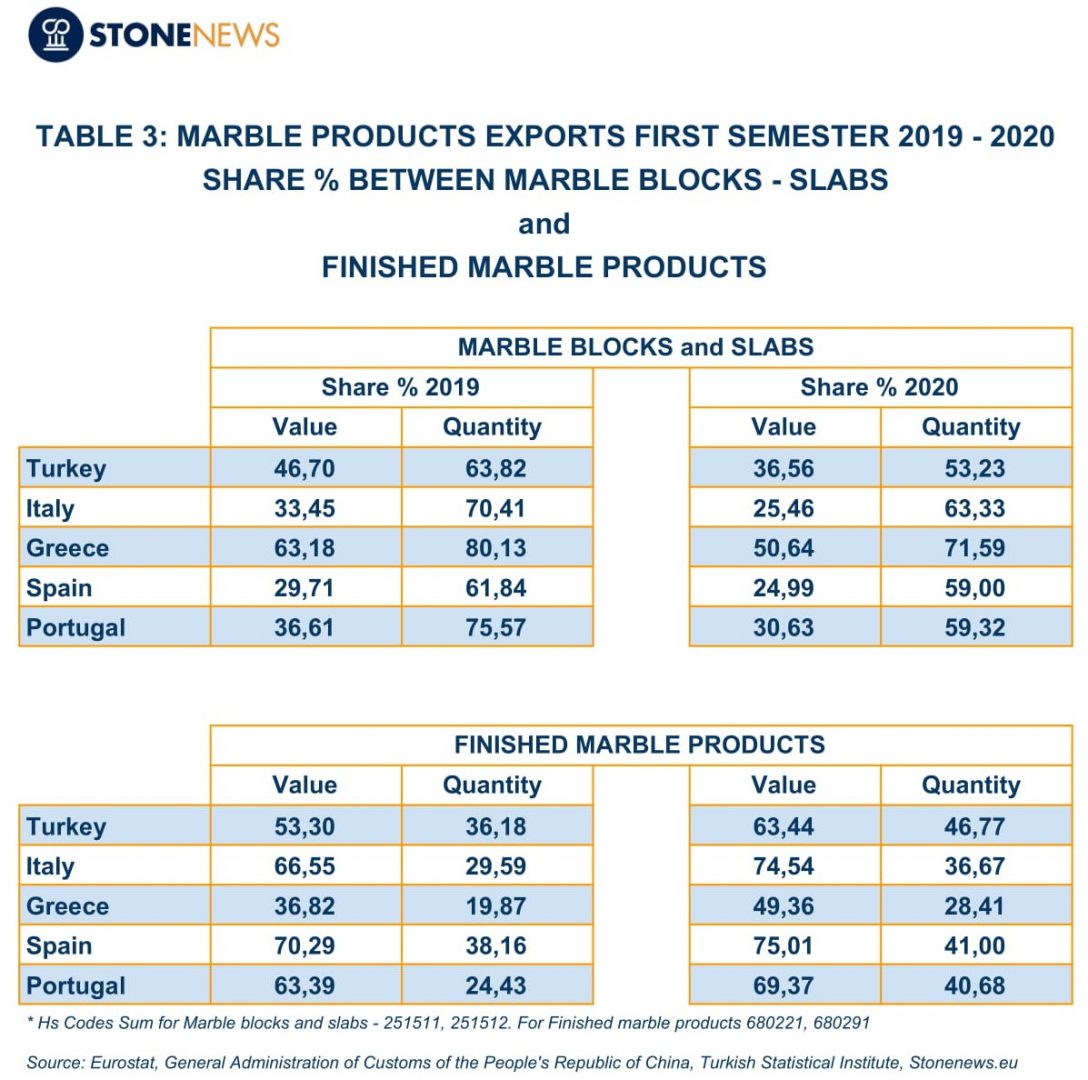

In the Table we observe the significant decline of the shares of raw marble compared to processed. The decrease in exports and the adjustment of the% shares between raw and finished marble also affected the prices per tonne. In Table 4 that follows we see the changes in the price per ton between AD Semester 2019 – 2020.

In the Table we observe the significant decline of the shares of raw marble compared to processed. The decrease in exports and the adjustment of the% shares between raw and finished marble also affected the prices per tonne. In Table 4 that follows we see the changes in the price per ton between AD Semester 2019 – 2020.

Given the effects of the pandemic and the lockdown, statistics show that countries with balanced exports of raw and finished marble and less dependent on China recorded lower losses.

Given the effects of the pandemic and the lockdown, statistics show that countries with balanced exports of raw and finished marble and less dependent on China recorded lower losses.

Recent statistics show some early signs of recovery, but imports of raw marble from China remain sluggish as the second wave of the pandemic has already begun to hit Europe and the US.

*Iran and Egypt are also among the largest suppliers of marble in the world but no monthly statistics are available for study and analysis.

*Due to consistent data flow, statistics may alter during the year

For more statistics contact [email protected]