People’s Bank of China braces for more and more strict banking regulations on bonds credit quality

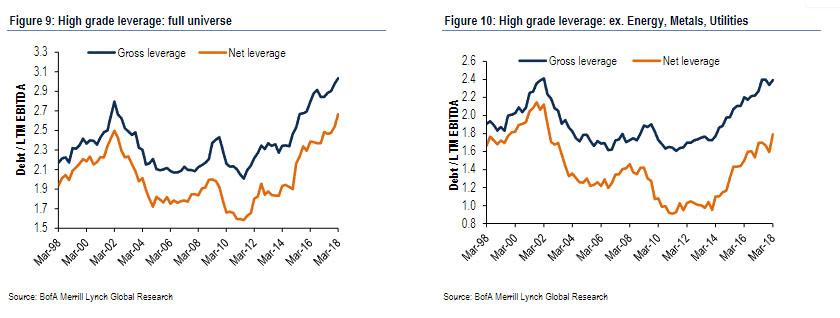

Bank of America in its recent report stressed that the american companies leverage has reached record levels

while at the same time Moody’s as well as banks active at reconstructing of firms point that the “party” in bond market is not over yet.

Both of the reports above suggest that some companies may face a crisis.

But what could happen if the next corporate debt crisis hits .China instead of U.S.A.?

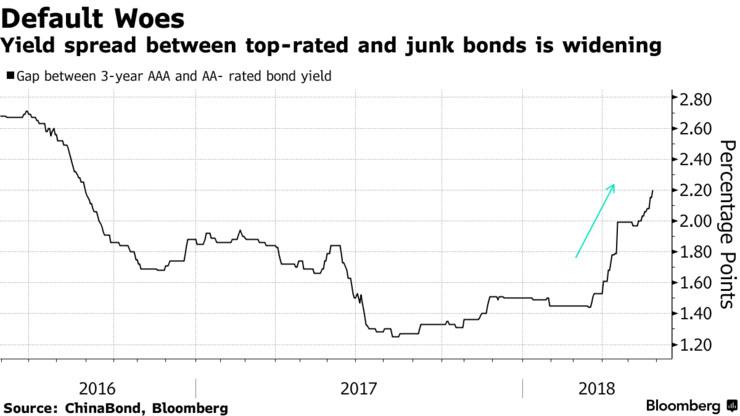

According to Logan Wright, director at Rhodium Group LLC research company in Hong Kong, during 2018 there have already been at least 14 corporate bonds payment defaults in China.

Regarding this issue, Economic Information Daily numbers these defaults up to 20 and the total amount of money never been deposited up to 17 billion CNY.

It is undoubtfully an impressive number, mainly for this specific country that had never heard about the term “corporate bankruptcy” since some years ago.

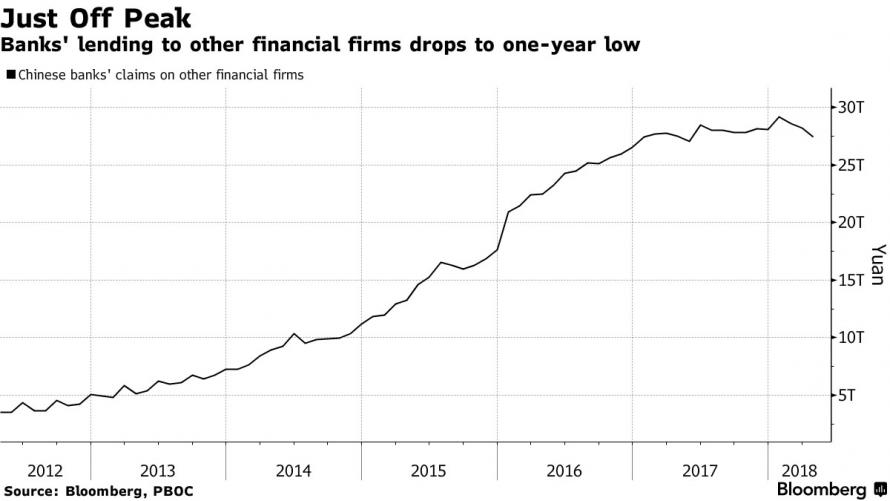

Furthermore, the chinese government has braced for more strict regulations on loan provision since 2017, givel that shadow banking in Hong Kong stands at 10 trillion dollars.

On the contrary, the bankw loaning to other financial corporations was reduced by 1,7 trillion CNY (about 265 billion U.S. dollars) during the first trimester of 2017.

The deleveraging process also reduces the bonding demand.

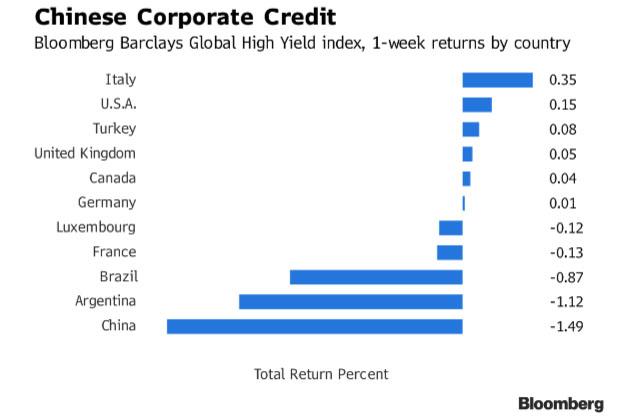

“Unlike U.S.A., where most of bonds buyers are mutual funds, individuals and investment companies, in China the main bondholders are banking groups”, Jason Bedford, UBS Group analyst, points.

Bloomberg reported that the four largest banks of China possess bonds of about 4,1 trillions CNY value issued by companies and other financial institutions by the end of 2017.

The figure is 20% lower than in 2016.

Therefore, it is no surprise that chinese corporate bonds, and mainly the most risky ones, have been affected during the last weeks.

The deterioration accelerated last week when state-owned China Energy Reserve & Chemicals Group failed to pay its loan.

This process scares mostly People’s Bank of China (PBOC), whose aim is to make it more difficult for the country’s official banking system to acquire low creditworthiness rated bonds.

Source: bankingnews.gr