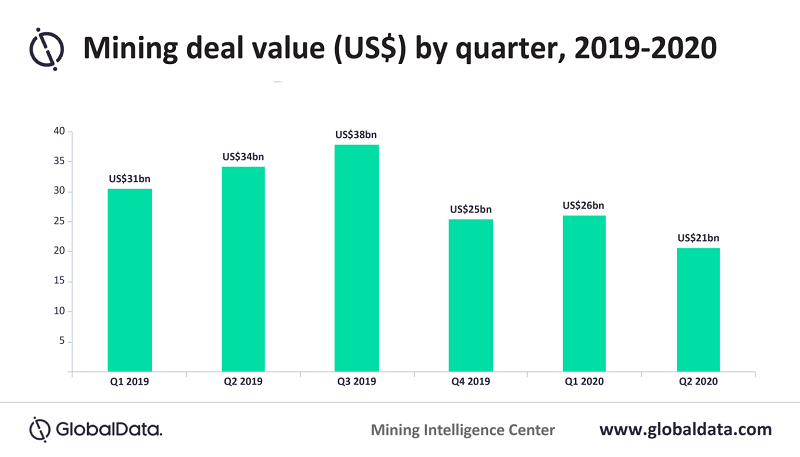

After a flat first quarter of 2020, the total value of mining deals – including mergers and acquisitions (M&A), capital raising and asset transactions – declined by US$5.3bn to US$20.6bn in Q2 2020, according to GlobalData, a leading data and analytics company.

Vinneth Bajaj, Senior Mining Analyst at GlobalData, comments: “Mining M&A values dropped by 30.5% or US$2.9bn in Q2 2020, while there was a 24.8% or US$3.7bn drop in the capital raised by mining companies during the second quarter. The number of asset transactions, however, rose by 84.9%, with a US$1.3bn increase in value.”

The total volume of deals increased from 860 in Q1 2020 to 1,411 in Q2 2020 owing to an 84.9% increase in the total number of completed asset transaction deals in that quarter. This was accompanied by a 53.4% increase in the volume of completed capital raising deals. Canada, Australia, the US and the UK accounted for over 90% of the total deal volume and over 50% of the total deal value.

Source: www.globaldata.com